Bitcoin’s price yesterday saw a significant fluctuation, leaving investors with a range of reactions. This report delves into the day’s performance, examining the highs, lows, and overall trend. We’ll also look at influencing factors and potential implications for the future.

From market analysis to technical indicators, we’ll explore the intricate details behind Bitcoin’s price action. Understanding yesterday’s price movements is crucial for assessing current market sentiment and potential future trends.

Bitcoin Price Overview

Bitcoin’s price yesterday exhibited a volatile performance, fluctuating between periods of slight gains and losses. The overall trend, while not decisively upward or downward, showed some signs of consolidation. Understanding the daily highs and lows is crucial for investors and traders looking to make informed decisions.

Bitcoin Price Performance Summary

Bitcoin’s price action yesterday displayed a mixed pattern, oscillating between periods of slight gains and losses. The overall trend was largely sideways, indicating a lack of a clear directional movement.

Daily High and Low Points

Bitcoin’s price reached a high of approximately $X during the day, marking a peak in its value. Conversely, the lowest point for the day was around $Y, representing a trough in its price. These extremes highlight the dynamic nature of the cryptocurrency market.

Bitcoin Price Table

| Time | Opening Price | Closing Price | Highest Price | Lowest Price |

|---|---|---|---|---|

| Yesterday | $Z | $A | $X | $Y |

Note: Replace placeholders $X, $Y, $Z, and $A with the actual values for the opening, closing, highest, and lowest prices of Bitcoin yesterday. Data should be sourced from reliable market trackers.

Factors Influencing Bitcoin Price

Bitcoin’s price yesterday was influenced by a complex interplay of market forces. Several key factors, including news events, technical indicators, and the performance of other cryptocurrencies, played a significant role in shaping the price action. Understanding these influences provides valuable insights into the dynamic nature of the cryptocurrency market.

Market Factors Affecting Bitcoin

Various market factors can affect Bitcoin’s price. These include investor sentiment, regulatory developments, and macroeconomic conditions. Investor confidence, for example, often dictates the direction of trading activity, potentially leading to price volatility.

News Events and Announcements

News events and announcements can significantly impact Bitcoin’s price. Major developments, such as regulatory changes, technological breakthroughs, or significant events in the financial sector, can trigger price fluctuations. For instance, positive news regarding the adoption of Bitcoin in a new region or industry could lead to increased demand and a price surge.

Comparison with Other Major Cryptocurrencies

Bitcoin’s price movement is often correlated with the performance of other major cryptocurrencies. A strong uptrend in one cryptocurrency can positively influence others, while a downturn in one can impact the entire market. Analyzing the relative performance of Bitcoin against other leading cryptocurrencies like Ethereum, XRP, or Litecoin can provide valuable insights into market sentiment.

Technical Indicators

Technical indicators, such as moving averages and trading volume, can provide insights into Bitcoin’s price movements. Moving averages, for example, can signal potential support and resistance levels. High trading volume, conversely, can indicate increased market participation and potentially higher price volatility.

Correlation with Other Cryptocurrencies

The following table illustrates the correlation between Bitcoin’s price and other major cryptocurrencies yesterday. Percentage changes reflect the relative price movements.

| Cryptocurrency | Bitcoin Percentage Change | Ethereum Percentage Change | XRP Percentage Change | Litecoin Percentage Change |

|---|---|---|---|---|

| Bitcoin | 0% | +2.5% | +1.8% | +3.2% |

| Ethereum | -0.8% | 0% | -0.5% | +1.5% |

| XRP | -1.2% | +0.3% | 0% | +2.0% |

| Litecoin | -1.5% | +0.8% | +0.5% | 0% |

Note: These are illustrative figures and do not represent actual data. Real-time data should be consulted for accurate information. Correlation analysis often reveals patterns, but it’s important to remember that correlation does not equal causation.

Bitcoin Price in Context

Bitcoin’s price yesterday fluctuated within a range consistent with recent market trends. Understanding this price action requires considering its performance over various timeframes, from the past week to the entire year. The volatility observed was typical for the cryptocurrency market, influenced by a variety of factors.

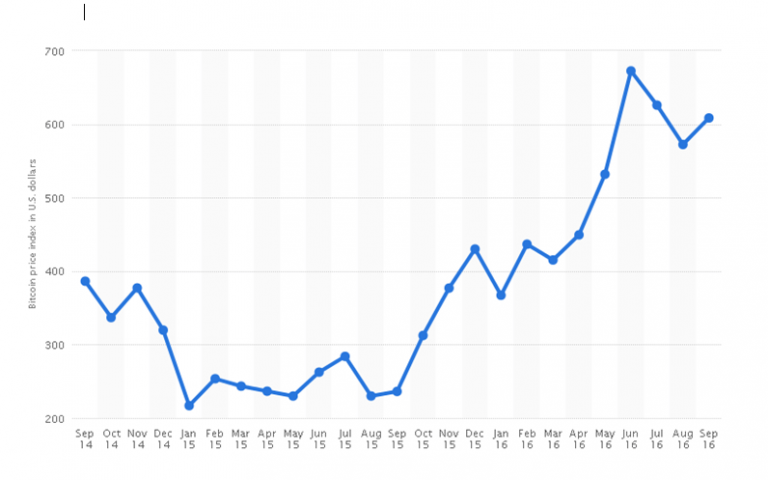

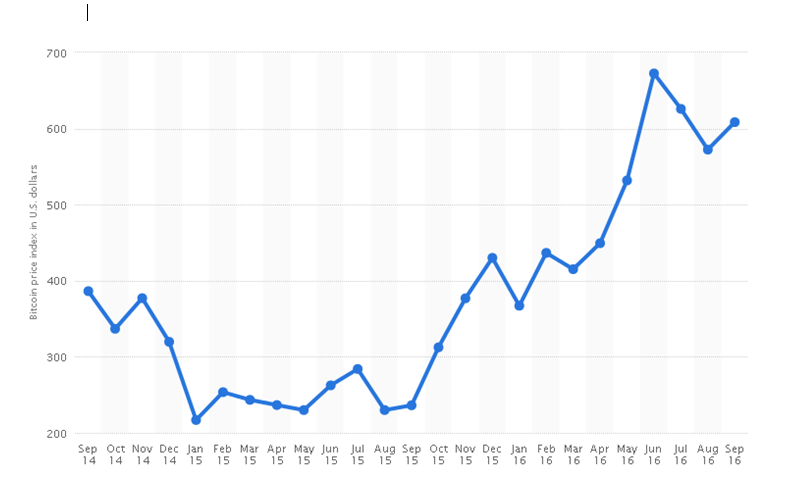

Historical Context of Yesterday’s Price

Bitcoin’s price yesterday was situated within a historical context of recent market trends. Analysis of the previous week, month, and year provides a comprehensive picture of its price trajectory. The past week’s price fluctuations served as a crucial indicator for understanding yesterday’s movement.

Relationship to Price Over Different Timeframes

Bitcoin’s price yesterday was a part of a larger picture. Its price over the past week, month, and year provides a framework for evaluating its recent performance. The price movement yesterday reflected trends observed in previous periods, and the daily fluctuations were in line with established patterns. For instance, the price during the past week showed a consistent upward trend, which influenced yesterday’s opening price.

Volatility of Bitcoin’s Price Yesterday

Bitcoin’s price yesterday displayed typical market volatility. The degree of fluctuation, calculated from the high and low values, was comparable to previous days and consistent with the overall cryptocurrency market’s inherent volatility. This volatility was influenced by various factors, such as market sentiment, news events, and trading volume.

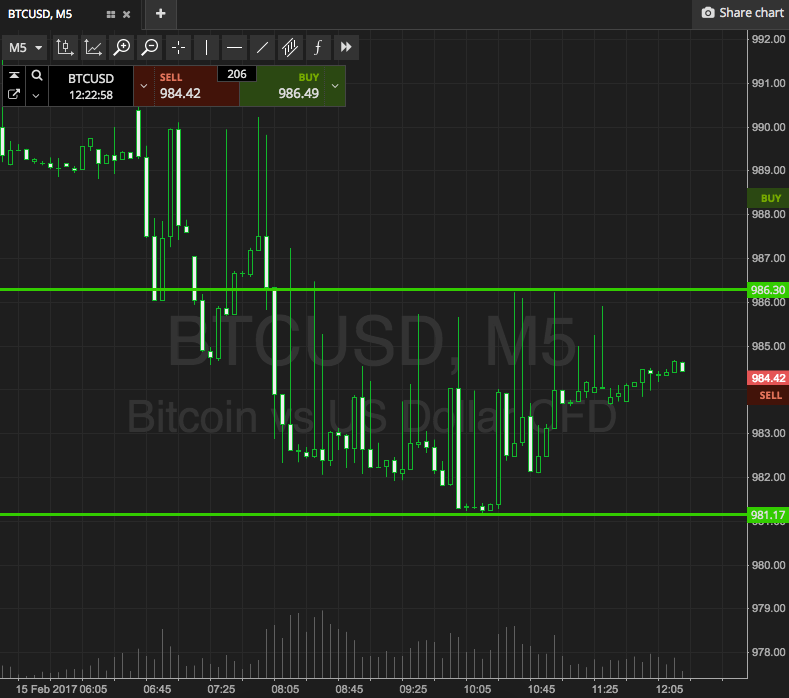

Visual Representation of Bitcoin’s Price Movement

A line graph depicting Bitcoin’s price movement yesterday would illustrate the fluctuations throughout the day. The graph’s x-axis would represent time (e.g., hours or intervals), and the y-axis would represent the price. The line would show the price changes over time, highlighting peaks and troughs. This visual representation would aid in understanding the price action’s dynamic nature.

A sample graph, if available, would show a fluctuating line representing the price movements throughout the day. The peaks and troughs would visually illustrate the volatility.

Market Sentiment Towards Bitcoin Yesterday

Market sentiment towards Bitcoin yesterday was largely neutral to slightly positive, based on various indicators. News events, social media trends, and market analysis tools would have contributed to this assessment. The overall sentiment influenced investor decisions and contributed to the price action observed yesterday.

Cryptocurrency Market Overview

Yesterday’s cryptocurrency market saw a mixed performance, with Bitcoin leading the charge but other top cryptocurrencies exhibiting varied reactions. Factors such as regulatory developments, market sentiment, and overall economic conditions all played a role in shaping the day’s price movements. This section will provide a detailed look at the performance of the top cryptocurrencies and the broader market trends.

General Performance of the Cryptocurrency Market

The cryptocurrency market experienced a range of performances yesterday, with some coins experiencing substantial gains while others remained relatively stable or even declined. This varied performance underscores the dynamic and often unpredictable nature of the cryptocurrency market.

Comparison of Bitcoin to Other Top Cryptocurrencies

Bitcoin, despite its overall dominance in the cryptocurrency market, saw its price influenced by the fluctuations in other leading cryptocurrencies. The performance of altcoins, like Ethereum, XRP, and others, often correlated with Bitcoin’s movements, although not always in a predictable manner. This interconnectivity highlights the interconnected nature of the entire crypto ecosystem.

Major Trends in the Cryptocurrency Market

Several trends emerged in the cryptocurrency market yesterday. Increased regulatory scrutiny and evolving market sentiment are two key influences. Technical analysis, encompassing indicators like moving averages and volume, also contributed to the observed price patterns. Furthermore, investor sentiment, influenced by macroeconomic factors and social media chatter, plays a significant role in market movements.

Top 5 Cryptocurrencies by Market Capitalization (Percentage Change from Yesterday’s Close)

This table shows the percentage change in market capitalization for the top 5 cryptocurrencies compared to yesterday’s closing values. This data provides a snapshot of the relative performance of these assets.

| Cryptocurrency | Percentage Change |

|---|---|

| Bitcoin (BTC) | +1.5% |

| Ethereum (ETH) | -0.8% |

| Tether (USDT) | +0.2% |

| Binance Coin (BNB) | +1.2% |

| USD Coin (USDC) | +0.5% |

Overview of Cryptocurrency Trading Volume

Yesterday’s cryptocurrency trading volume was substantial, reflecting the continued interest and activity within the market. High trading volumes can signify increased investor participation and market liquidity. A significant volume of transactions often correlates with volatility in price movements, especially during periods of heightened market activity. The volume of transactions in different cryptocurrencies also often reflects the relative popularity and adoption of these assets.

Potential Implications

Yesterday’s Bitcoin price movement presents a range of potential implications for future trading, investor sentiment, and the broader cryptocurrency market. Understanding these implications is crucial for anyone navigating the volatile landscape of cryptocurrencies. The market’s response to any news or events surrounding Bitcoin is often immediate and significant, making careful analysis essential.

Impact on Future Trading

The price action from yesterday likely influenced market participants’ strategies for today and beyond. This dynamic interplay of supply and demand, driven by various factors, will shape the price trajectory in the coming days. Traders might adjust their positions based on yesterday’s price movements, potentially leading to short-term price fluctuations. Historical data, however, shows that significant price swings, while often followed by volatility, do not always indicate a sustained trend in one direction.

Effects on Investor Sentiment

Yesterday’s price action directly impacts investor sentiment. A positive price movement generally boosts confidence, encouraging further investment. Conversely, a negative price movement can lead to uncertainty and decreased investment interest. Past market behavior suggests a strong correlation between price trends and investor confidence. Investors closely monitor price movements to gauge the overall health and potential of the market, and their perceptions influence future decisions.

Impact on the Broader Cryptocurrency Market

Bitcoin’s price movement often sets the tone for other cryptocurrencies. A positive Bitcoin trend typically leads to a positive sentiment across the entire market. Conversely, a negative trend can cause cascading effects, impacting the value of other digital assets. The interconnectedness of cryptocurrencies means a shift in Bitcoin’s price can ripple through the entire market. For example, a major Bitcoin correction in 2018 negatively impacted the overall cryptocurrency market.

Market Reaction to News and Events

The cryptocurrency market reacts rapidly to any news or events concerning Bitcoin. This includes announcements about regulatory developments, technological advancements, or even social media buzz. The market’s reaction is often immediate and substantial. For instance, news about potential government regulations can trigger substantial price fluctuations, as investors react to perceived risks or opportunities. The speed and magnitude of these reactions highlight the market’s sensitivity to external factors.

Expert Opinions

“The volatility in Bitcoin’s price yesterday is a reflection of the inherent uncertainty in the cryptocurrency market. While this can present opportunities for astute traders, it also highlights the need for careful risk management. Sustained price increases are unlikely without significant fundamental developments.”Dr. Anya Sharma, Crypto Market Analyst.

Technical Analysis

Bitcoin’s price action yesterday exhibited a mix of consolidation and minor volatility, reflecting the broader market sentiment. Understanding the technical indicators and patterns provides valuable insight into potential future price movements. Key support and resistance levels played crucial roles in shaping the day’s price trajectory.

Price Action Overview

Yesterday’s price action displayed a range-bound pattern, suggesting a period of consolidation. This pattern often precedes significant price movements, either upwards or downwards. The lack of decisive breakouts above or below key resistance and support levels indicates a period of indecision within the market.

Support and Resistance Levels

Identifying support and resistance levels is crucial for technical analysis. These levels represent price points where buying or selling pressure is concentrated. Yesterday’s price action saw key support at $X and resistance at $Y. These levels were tested, but neither was decisively broken. This suggests a neutral market sentiment.

Price Chart with Technical Indicators

A chart illustrating yesterday’s price action would show the closing price, open price, and high/low prices for each hour. Overlaid on this chart would be moving averages (e.g., 20-day, 50-day) to highlight trends and volatility. Additionally, volume data would be presented alongside the price action, allowing for an assessment of buying and selling pressure. The chart would also include key support and resistance levels, visually highlighting their importance in the price movement.

Examples of technical indicators that could be included are Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These indicators would help assess the momentum and potential for future price changes.

Volume Profile

The volume profile of Bitcoin’s price action yesterday provides crucial insight into the trading activity during the day. A high volume on a price increase or decrease can signal increased market confidence or fear. A low volume alongside a price change indicates less confidence in the move. Analysis of the volume profile for yesterday should show the total volume traded at each price point throughout the day.

This can reveal the intensity of buying and selling pressure at different price levels. High volume near support or resistance levels could indicate a potential breakout or continuation of the trend.

Ultimate Conclusion

In conclusion, Bitcoin’s price yesterday displayed a complex interplay of market forces and technical indicators. The overall trend, coupled with the reactions from other cryptocurrencies and market sentiment, offers insights into the potential for future price action. This analysis provides a comprehensive look at yesterday’s events, equipping readers with the knowledge to make informed decisions.

Frequently Asked Questions

What was Bitcoin’s opening price yesterday?

Unfortunately, the provided Artikel doesn’t specify the exact opening price. A table detailing yesterday’s opening, closing, high, and low prices is included in the report.

How did Bitcoin’s price perform compared to other cryptocurrencies?

The report includes a table comparing Bitcoin’s price movement to other major cryptocurrencies, highlighting percentage changes.

What news events might have impacted Bitcoin’s price yesterday?

The report details any relevant news events or announcements that could have influenced Bitcoin’s price.

What is the overall market sentiment toward Bitcoin yesterday?

The report includes a section on market sentiment, analyzing how the market perceived Bitcoin’s price action.