Crypto coins for sale are reshaping the financial landscape, creating exciting opportunities for both seasoned investors and newcomers alike. As digital currencies continue to gain traction, understanding the different types available and their significance in the evolving digital economy is essential for making informed purchasing decisions.

This overview will guide you through the various popular crypto coins on the market, the best platforms for buying them, and the key factors to consider before diving into this dynamic investment space.

Introduction to Crypto Coins for Sale

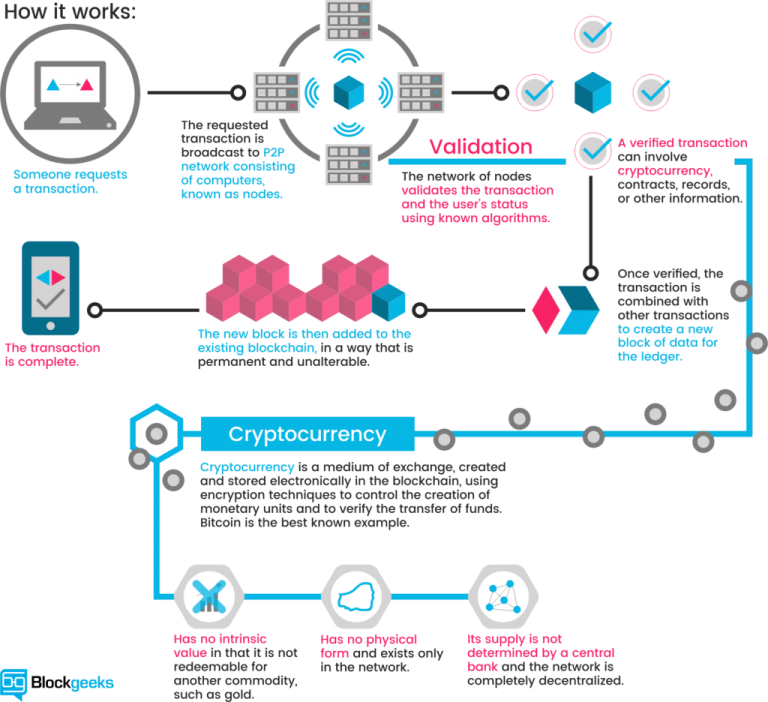

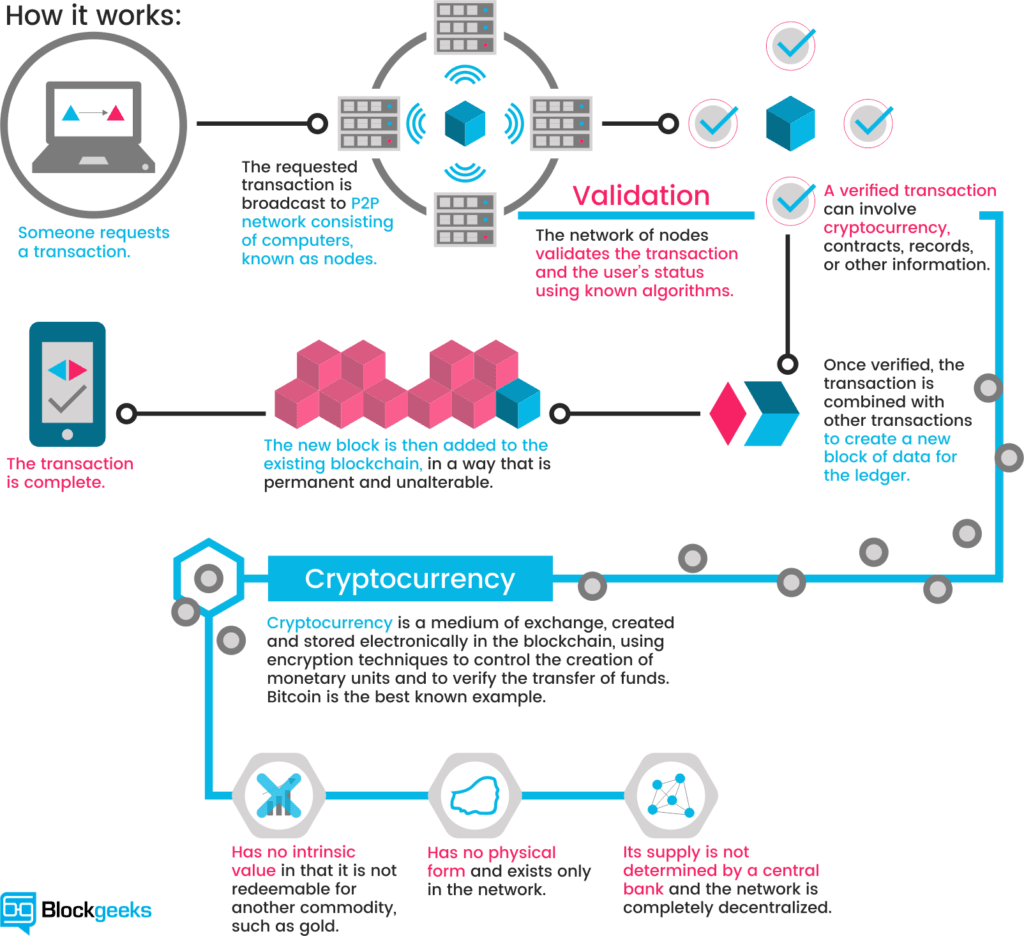

In recent years, crypto coins have emerged as a significant player in the digital economy, revolutionizing the way we perceive and conduct transactions. Crypto coins, or cryptocurrencies, are digital assets designed to work as a medium of exchange using cryptography for secure transactions. Their significance lies in their ability to facilitate decentralized financial transactions, enabling users to operate without the need for traditional banking systems or intermediaries.

There are various types of crypto coins available for sale, each serving different purposes and catering to diverse audiences. These include Bitcoin, Ethereum, stablecoins, and altcoins, among others. Understanding the market landscape before purchasing any crypto coin is crucial. It helps potential buyers make informed decisions, assess risks, and gauge the potential returns on their investments.

Popular Crypto Coins for Sale

The world of crypto coins is vast, but some coins stand out due to their popularity and market performance. Knowing these coins can guide investors in their purchasing decisions.

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold. Bitcoin has a capped supply of 21 million coins, making it a deflationary asset.

- Ethereum (ETH): Known for its smart contract functionality, Ethereum enables developers to build decentralized applications (dApps) on its blockchain, expanding its use case beyond just a currency.

- Binance Coin (BNB): Initially created as a utility token for the Binance exchange, BNB has expanded its use cases and gained value through various applications within the Binance ecosystem.

- Cardano (ADA): Aimed at creating a more secure and scalable blockchain, Cardano utilizes a unique proof-of-stake consensus mechanism, making it an attractive option for eco-conscious investors.

The market performance of these coins varies, with Bitcoin and Ethereum often leading the charge. Bitcoin has historically been the most valuable crypto coin, while Ethereum signifies innovation within the blockchain realm, contributing to its significant market capitalization.

Where to Buy Crypto Coins

Acquiring crypto coins can be done through various platforms, each offering unique features for buyers. Here are some of the top platforms:

- Coinbase: A user-friendly platform ideal for beginners, Coinbase allows users to buy, sell, and store a variety of cryptocurrencies with ease. It also provides educational resources.

- Binance: Known for its extensive selection of crypto coins and trading pairs, Binance is favored by traders looking for lower fees and advanced trading options.

- Kraken: This platform offers a secure environment with strong regulatory compliance, making it a good choice for safety-conscious investors.

Each platform has its own buying process, typically involving account creation, verification, and linking a payment method. While Coinbase is simple for beginners, Binance offers more sophisticated trading tools for experienced users.

Factors to Consider When Buying Crypto Coins

Investing in crypto coins comes with its own set of risks. Understanding these risks is vital for making informed decisions.

- Market Volatility: Crypto markets often experience extreme fluctuations in prices, which can result in significant gains or losses within short timeframes.

- Liquidity: Ensuring that a coin has adequate liquidity is crucial; otherwise, it may be challenging to buy or sell without impacting the price.

- Regulatory Risks: The evolving landscape of crypto regulations can affect the viability of certain coins, making it essential to stay informed on legal developments.

Evaluating which coins to purchase involves considering factors such as market performance, the team behind the project, technology, and use cases.

Crypto Coins Investment Strategies

Creating a diversified portfolio is key to managing risks in crypto investments. Here’s a guide to effective strategies:

- Diversification: Invest across different types of coins to mitigate risk associated with any single asset.

- Long-term Holding: Many successful investors adopt a “hold” strategy, believing in the long-term potential of their assets.

- Active Trading: For those with market knowledge, active trading can maximize returns through market timing.

Balancing long-term and short-term strategies can provide a well-rounded approach to crypto investments.

Legal Considerations for Purchasing Crypto Coins

Understanding the legal landscape is crucial when engaging in crypto transactions. Different regions have varying regulations concerning buying and selling crypto coins.

- Regulatory Requirements: Some countries require users to verify their identity and report capital gains, while others remain more lenient.

- Tax Implications: Many jurisdictions tax crypto transactions as capital gains, necessitating proper record-keeping by investors.

- Resources: Staying updated on regulations can be done through crypto news sites or government websites that monitor digital asset regulations.

Being informed can save investors from legal troubles and ensure compliance with existing laws.

Security Measures for Crypto Coin Transactions

Securing crypto assets is paramount in an increasingly digital world. Various measures can help protect investments:

- Secure Wallets: Using hardware wallets or secure software wallets can safeguard coins from hacks or breaches.

- Best Practices: Regularly updating passwords, enabling two-factor authentication, and being cautious of phishing scams enhance security.

- Avoiding Scams: Awareness of common scams, such as fake exchanges or Ponzi schemes, is crucial for safe investing.

Implementing these security measures can significantly reduce the risk of losing assets.

Future Trends in Crypto Coins

The crypto coin market is continuously evolving, with emerging trends shaping its future.

- Decentralized Finance (DeFi): This trend decentralizes traditional financial systems, allowing users to lend, borrow, and trade directly on blockchain platforms.

- Non-Fungible Tokens (NFTs): NFTs are gaining traction, representing ownership of unique digital items and expanding the use of blockchain technology.

- Regulatory Developments: As governments create clearer regulations around cryptocurrencies, the market may experience stabilization and increased legitimacy.

Investors should watch these developments closely, as they present potential opportunities and challenges in the crypto landscape.

Last Word

In conclusion, exploring crypto coins for sale is not just about buying into a trend; it’s about understanding the intricate details that come with digital investments. With the right knowledge, strategies, and awareness of market conditions, investors can navigate the exciting world of crypto and potentially reap significant rewards.

Top FAQs

What are crypto coins?

Crypto coins are digital currencies that use cryptography for security and operate on blockchain technology.

How do I choose which crypto coins to buy?

Evaluate factors like market performance, technology behind the coin, and overall liquidity.

Are there risks involved in buying crypto coins?

Yes, there are risks including market volatility, security threats, and regulatory changes.

What platforms are best for buying crypto coins?

Popular platforms include Coinbase, Binance, and Kraken, each with unique features and fee structures.

How do I secure my crypto coins?

Use secure wallets, enable two-factor authentication, and stay informed about common scams in the market.