Can you buy Bitcoin at an ATM? Absolutely! Bitcoin ATMs offer a convenient alternative to traditional exchanges for acquiring Bitcoin. This guide delves into the world of Bitcoin ATMs, exploring their functionality, advantages, risks, and much more.

Understanding the process, comparing options, and knowing the potential pitfalls is crucial. From the technical aspects of transactions to the security considerations, this guide will equip you with the knowledge needed to navigate the Bitcoin ATM landscape safely and effectively.

Introduction to Bitcoin ATM Transactions

Bitcoin ATMs, or Bitcoin Automated Teller Machines, are self-service kiosks that allow users to buy and sell Bitcoin (BTC) directly. They provide a convenient alternative to traditional exchanges for acquiring Bitcoin, particularly in locations where access to traditional banking services might be limited. This accessibility is a key advantage, but users should be aware of the associated risks and fees.The process of purchasing Bitcoin via a Bitcoin ATM is straightforward.

Users typically insert cash, select the desired amount of Bitcoin to purchase, and receive the equivalent amount in Bitcoin credited to a digital wallet address. Verification steps, such as entering a PIN or scanning a QR code, are often required to ensure security. The transaction is usually completed within a few minutes, making it a relatively quick process.

Bitcoin ATM Types

Bitcoin ATMs vary in their features and functionalities. Some offer a wider range of currencies for purchase and sale, while others might specialize in specific regions or cryptocurrencies. There are ATMs designed for high-volume transactions, suitable for larger businesses or institutional investors, and ATMs optimized for small purchases, ideal for individual users. The functionalities and support offered by the ATM significantly influence the user experience.

Bitcoin ATM Providers

Different providers offer Bitcoin ATM services, with varying levels of fees and supported currencies. This diversity in providers creates a competitive market, offering users choices in terms of pricing and availability. A comprehensive list of providers helps users to identify suitable options based on their location and needs.

| Provider Name | Location | Fees | Supported Currencies |

|---|---|---|---|

| CoinATM | Globally | Variable, dependent on transaction amount and location | USD, EUR, GBP, and other major fiat currencies |

| Bitcoin Depot | USA | Variable, dependent on transaction amount and location | USD |

| General Bytes | USA | Variable, dependent on transaction amount and location | USD |

| Bitaccess | Globally | Variable, dependent on transaction amount and location | USD, EUR, GBP, and other major fiat currencies |

Buying Bitcoin with ATMs

Bitcoin ATMs provide a convenient, albeit sometimes limited, way to purchase Bitcoin. They offer an alternative to traditional exchanges, particularly for those who prefer a more immediate transaction or lack the technical knowledge needed for online platforms. However, this convenience comes with trade-offs, including security concerns and potentially higher transaction fees.The ease of use of Bitcoin ATMs is often cited as a major advantage.

Users can typically complete a purchase within minutes, without the need for extensive account setup or verification processes. This accessibility can be attractive for casual investors or those seeking a quick entry point into the cryptocurrency market. While this immediacy is beneficial, it’s important to acknowledge the potential drawbacks, such as transaction fees and security considerations.

Advantages of Bitcoin ATMs

Bitcoin ATMs offer a tangible and immediate experience for purchasing Bitcoin. This physical interaction can be appealing to those who prefer hands-on transactions. They also often provide a convenient alternative for those in locations where traditional banking or exchange services may be less readily available. This physical presence can be particularly useful in underserved communities.

Disadvantages of Bitcoin ATMs

While Bitcoin ATMs offer a degree of accessibility, they also come with limitations. One key concern is the potential for higher transaction fees compared to some exchange platforms. Additionally, the security of the transaction is reliant on the ATM provider, and the level of security measures implemented can vary. The reliability of the ATM itself is another factor to consider, as malfunctions can cause delays or even losses.

Security Measures of Reputable Bitcoin ATM Providers

Reputable Bitcoin ATM providers typically employ various security measures to protect user funds. These measures often include robust encryption protocols to safeguard transactions and protect sensitive data. They also frequently use multi-factor authentication systems to verify user identities and prevent unauthorized access. Physical security measures, such as security cameras and alarm systems, are often integrated to deter potential theft or vandalism.

Regular security audits and maintenance protocols further contribute to a secure environment.

Factors Influencing Bitcoin ATM Transaction Fees

Bitcoin ATM transaction fees are influenced by several factors. The volume of transactions, the location of the ATM, and the specific provider all play a role in the final fee. Providers might adjust fees based on market conditions or transaction volume, as well as other factors.

Comparison of Bitcoin ATM Transaction Fees

| Bitcoin ATM Provider | Typical Transaction Fee (USD) | Notes |

|---|---|---|

| Provider A | $10-$20 | Known for higher fees in some locations. |

| Provider B | $5-$15 | Generally more competitive pricing. |

| Provider C | $8-$18 | Fees vary based on the specific ATM location. |

Note: These are examples, and fees can vary significantly. Always check the current fee structure with the specific ATM provider.

Factors Influencing Bitcoin ATM Availability

Bitcoin ATMs, offering a convenient method for buying and selling Bitcoin, are not uniformly distributed globally. Their presence is shaped by a complex interplay of geographical, regulatory, and market-driven forces. Understanding these factors is crucial for assessing the future of Bitcoin ATM adoption.Geographic distribution of Bitcoin ATMs is uneven, with certain regions having significantly more ATMs than others.

This disparity is influenced by a multitude of variables, impacting accessibility and usage.

Geographic Distribution of Bitcoin ATMs

Bitcoin ATM availability is not consistent across the globe. Concentrations often align with regions having high levels of cryptocurrency adoption and trading activity. Areas with a strong presence of cryptocurrency enthusiasts and investors frequently see a greater density of Bitcoin ATMs. This concentration is not random; it’s driven by the demand and potential for profitable operations in these regions.

Factors Impacting Bitcoin ATM Availability

Several factors influence the presence of Bitcoin ATMs in different regions. Regulatory frameworks play a significant role, as do local market conditions and the overall demand for Bitcoin services.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies and Bitcoin ATMs varies substantially from country to country. Some jurisdictions have explicit regulations governing the operation of Bitcoin ATMs, while others have a more permissive approach. Clear and consistent regulations provide a stable environment for Bitcoin ATM operators. Conversely, unclear or restrictive regulations can discourage their deployment.

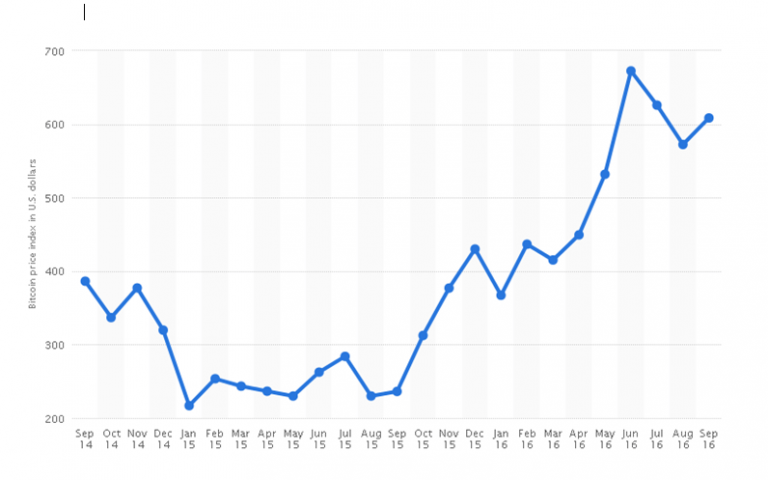

- Market Trends: The adoption of Bitcoin and other cryptocurrencies has a direct impact on Bitcoin ATM deployment. Increased market interest and price volatility can stimulate demand, prompting more operators to deploy ATMs. Conversely, periods of market downturn or decreased user interest may lead to a reduction in Bitcoin ATM availability.

- Local Market Conditions: Local market conditions, including the level of financial literacy and digital adoption in a given region, affect the demand for Bitcoin ATMs. In regions with high levels of financial literacy and internet penetration, the demand for Bitcoin ATMs is typically higher.

Regulatory Landscape Surrounding Bitcoin ATMs

The regulatory landscape for Bitcoin ATMs is in a state of flux globally. Governments are grappling with how to regulate this emerging technology, balancing consumer protection with innovation. Some countries have established clear regulatory frameworks, while others are still developing their approaches. A lack of clear regulations can create uncertainty and risk for operators.

Impact of Market Trends on Bitcoin ATM Adoption

Bitcoin ATM deployment is closely linked to market trends. Periods of heightened interest and rising Bitcoin prices often result in increased adoption. Conversely, market downturns or periods of reduced interest can cause a decrease in ATM deployment. Understanding these market forces is essential for assessing the future trajectory of Bitcoin ATM availability.

Table: Estimated Bitcoin ATM Distribution (Illustrative)

| Region | Estimated Number of ATMs |

|---|---|

| North America | 10,000-15,000 |

| Europe | 5,000-7,000 |

| Asia | 3,000-5,000 |

| South America | 1,000-2,000 |

| Africa | 500-1,000 |

Note: This table provides an illustrative estimate and is not a precise count. Data on Bitcoin ATM distribution is often not publicly available.

Bitcoin ATM Transactions

Bitcoin ATMs offer a convenient way to buy and sell Bitcoin, but understanding the underlying technical processes is crucial for a smooth and secure transaction. These ATMs use specialized software and hardware to facilitate transactions, ensuring the integrity and security of Bitcoin holdings. This section delves into the technical intricacies of these transactions, highlighting cryptographic security and the various payment methods accepted.

Technical Process of Bitcoin Transactions on ATMs

Bitcoin ATM transactions typically involve a series of steps. First, the user selects the desired amount of Bitcoin to buy or sell. The ATM then verifies the user’s identity and initiates the transaction. Next, the ATM securely generates a Bitcoin transaction on the blockchain. Crucially, this transaction is cryptographically signed and verified by both the user and the ATM’s backend system.

Finally, the user receives their Bitcoin and the ATM’s system records the transaction for future reference.

Cryptographic Security in Bitcoin ATM Transactions

Robust cryptographic security is fundamental to Bitcoin ATM transactions. The transactions utilize cryptography to protect the integrity and confidentiality of the Bitcoin exchanged. This involves digital signatures, ensuring that only authorized parties can access or modify the transaction data. Public-key cryptography is employed to encrypt sensitive information and verify the authenticity of transactions. Advanced security measures prevent unauthorized access to user funds and maintain the integrity of the entire system.

This cryptographic security layer is vital to safeguarding Bitcoin held within the ATM’s system and the user’s Bitcoin holdings.

Payment Methods Accepted by Bitcoin ATMs

Bitcoin ATMs often accept various payment methods, including credit and debit cards. A significant number of ATMs also support bank transfers, allowing users to purchase Bitcoin using their bank accounts. The specific payment methods accepted can vary from one ATM to another, so it is crucial to verify the ATM’s capabilities before initiating a transaction.

| Payment Method | Description |

|---|---|

| Credit/Debit Cards | Common payment options, allowing users to directly purchase Bitcoin with their credit or debit cards. |

| Bank Transfers | Transactions processed through a bank account, offering an alternative payment method for Bitcoin purchases. |

| Cash | Some Bitcoin ATMs accept cash for Bitcoin transactions. This is often used for lower-value purchases. |

Troubleshooting Common Issues During a Bitcoin ATM Transaction

Difficulties can arise during Bitcoin ATM transactions. If the transaction fails, ensure the ATM is properly connected to the Bitcoin network. Verify that sufficient funds are available in the payment method selected. If the ATM requests further identification, comply with the security measures to verify the user’s identity. In case of persistent issues, contacting the ATM operator or the Bitcoin exchange is recommended.

These measures are crucial for resolving any problems and completing the transaction successfully.

Alternatives to Buying Bitcoin Via ATMs

Purchasing Bitcoin via an ATM offers a convenient, on-the-spot option, but it’s not the only avenue available. Alternative methods, such as using cryptocurrency exchanges, offer broader functionalities and often lower fees. Understanding these alternatives is crucial for informed decision-making.

Different Bitcoin Buying Platforms

Various platforms facilitate Bitcoin purchases, each with its own strengths and weaknesses. Exchanges, for example, are online platforms that provide a marketplace for trading various cryptocurrencies, including Bitcoin. Specialized Bitcoin-only platforms are also common, focusing solely on Bitcoin transactions.

Comparison of Bitcoin Buying Methods

A key consideration when choosing a Bitcoin buying method is the ease of use. Using an ATM for Bitcoin purchases is straightforward, requiring minimal technical knowledge. Conversely, using a cryptocurrency exchange often involves creating an account and understanding trading mechanics.

Ease of Use

Purchasing Bitcoin via an ATM is generally easier for beginners. The process is usually straightforward and accessible to individuals without extensive technical expertise. In contrast, using an exchange may require more setup, including account creation and understanding of the platform’s interface. Navigating exchange platforms can present a learning curve, particularly for novice users.

Fees

Fees associated with Bitcoin purchases vary significantly between methods. ATMs often impose transaction fees, potentially adding to the overall cost. Exchanges may charge trading fees or platform fees, which are frequently more transparent and often lower than ATM fees. The choice of platform directly impacts the total transaction cost.

Security Considerations

Security is paramount when dealing with cryptocurrency. ATMs may have limited security measures, whereas exchanges usually offer robust security protocols, including multi-factor authentication (MFA) and secure servers. Storing your cryptocurrency securely after purchasing is equally critical, regardless of the platform used.

Comparison Table

| Feature | ATM | Exchange | Specialized Bitcoin Platform |

|---|---|---|---|

| Ease of Use | High (for beginners) | Medium (requires account setup) | Medium (requires account setup, often less complex than general exchanges) |

| Fees | Higher (potentially significant transaction fees) | Lower (often transparent and competitive) | Lower (often competitive) |

| Security | Lower (limited security measures) | High (robust security protocols) | Medium (often with a strong focus on security) |

| Transaction Speed | Fast (immediate) | Variable (depends on network conditions and exchange processes) | Variable (depends on network conditions) |

Security Considerations When Using Bitcoin ATMs

Bitcoin ATMs, while convenient, present security challenges. Understanding the potential risks and taking precautions is crucial to safeguarding your digital assets. Carefully verifying the legitimacy of the ATM and adhering to secure transaction practices are paramount.Using a Bitcoin ATM can be a quick way to buy or sell Bitcoin, but it’s essential to prioritize security to avoid losing your investment.

This involves recognizing the potential for scams and fraudulent activities and implementing protective measures to minimize the risks.

Verifying Bitcoin ATM Legitimacy

Ensuring the Bitcoin ATM’s authenticity is a fundamental step in safeguarding your transaction. Look for verifiable information, such as the ATM’s registration, licensing, and any official affiliations. Checking reviews from other users can also provide valuable insights into the ATM’s reliability. A reputable Bitcoin ATM should display clear information about its operator, contact details, and terms of service.

Steps for a Secure Bitcoin ATM Transaction

A secure Bitcoin ATM transaction begins with thorough preparation. Carefully review the transaction details on the ATM’s screen before confirming. Ensure that the displayed amount and transaction details are accurate and match your intended transaction. Maintain a vigilant attitude during the transaction process and avoid distractions. Do not share your PIN or private keys with anyone.

Use a secure internet connection and a reputable device when interacting with the ATM.

Risks of Using Unverified Bitcoin ATMs

Using an unverified Bitcoin ATM significantly increases the risk of fraud or loss. Unverified ATMs may not adhere to industry standards, potentially exposing you to malware, scams, or outright theft of your funds. The absence of regulatory oversight and the lack of transparent information regarding the operator further amplify the risks. Remember, dealing with untrusted sources exposes you to unauthorized access to your account or Bitcoin holdings.

Protecting Your Bitcoin Holdings

After acquiring Bitcoin via an ATM, secure storage is paramount. Import your Bitcoin private keys into a secure wallet. A hardware wallet, known for its physical security and offline access, offers enhanced protection against cyberattacks. Diversifying your holdings among multiple secure wallets and regularly backing up your wallet data further mitigates the risk of loss.

Safety Tips When Using Bitcoin ATMs

- Thorough Verification: Always verify the Bitcoin ATM’s legitimacy before using it. Check for certifications, reviews, and any information regarding the ATM’s operator.

- Secure Transactions: Carefully review all transaction details on the ATM screen before confirming the purchase. Avoid using public Wi-Fi during the process.

- Private Information Protection: Never share your PIN or private keys with anyone. Keep your personal information private.

- Secure Storage: Immediately store your Bitcoin in a reputable and secure wallet. Avoid using public computers or unsecured devices when accessing your Bitcoin wallet.

- Regular Backups: Regularly back up your wallet data to protect against data loss or hardware failure. This will safeguard your Bitcoin investment in case of any unexpected event.

Purchasing Bitcoin

Bitcoin, a digital or cryptocurrency, has emerged as a significant player in the global financial landscape. Its decentralized nature and potential for high returns have attracted considerable interest, leading to its widespread adoption, even if it’s still relatively new compared to traditional currencies. This section delves into the Bitcoin ecosystem, its role in finance, and crucial aspects of purchasing Bitcoin.Understanding Bitcoin’s position within the financial system requires a grasp of its decentralized nature.

This unique characteristic distinguishes it from traditional fiat currencies, allowing for peer-to-peer transactions without intermediaries. This decentralized model has fostered innovation and challenged established financial norms, prompting a global conversation about alternative financial systems.

Overview of the Bitcoin Ecosystem

The Bitcoin ecosystem is multifaceted, encompassing various components and participants. Its decentralized structure allows for a broad range of services and activities, fostering a dynamic environment. Understanding these key elements is crucial for navigating the Bitcoin landscape.

- Bitcoin Mining: The process of verifying and adding new transactions to the Bitcoin blockchain is known as mining. Specialized computers compete to solve complex mathematical problems, rewarding successful miners with newly created Bitcoin. This process is critical to maintaining the integrity and security of the Bitcoin network.

- Bitcoin Wallets: These digital wallets serve as repositories for Bitcoin holdings. Different types of wallets exist, ranging from software-based applications to hardware devices, each offering varying levels of security and functionality. Security is paramount when selecting a Bitcoin wallet.

- Bitcoin Exchanges: These platforms facilitate the buying and selling of Bitcoin. Exchanges connect buyers and sellers, enabling the conversion of Bitcoin to fiat currencies or other cryptocurrencies. A wide range of exchanges cater to different user needs and risk tolerances.

- Bitcoin Blockchains: The Bitcoin blockchain is a public, immutable ledger that records all Bitcoin transactions. This decentralized database ensures transparency and security, as every transaction is permanently recorded and visible to all participants.

Role of Bitcoin in the Financial World

Bitcoin’s emergence has challenged conventional financial paradigms. Its decentralized nature and potential for high returns have sparked interest from both institutional and individual investors.

- Alternative Investment Vehicle: Bitcoin is increasingly seen as an alternative investment asset class. Its potential for high returns and diversification benefits has drawn significant investor attention, but it’s also important to recognize the associated risks.

- Cross-border Payments: Bitcoin’s ability to facilitate instant, low-cost cross-border transactions is a significant advantage. This capability is especially relevant for international remittances and global trade.

- Financial Inclusion: Bitcoin has the potential to offer financial services to unbanked populations, providing a means for accessing financial systems in areas where traditional banking infrastructure is lacking.

Bitcoin as a Decentralized Currency

Bitcoin’s decentralized nature distinguishes it from traditional fiat currencies. This characteristic allows for peer-to-peer transactions without intermediaries, promoting greater financial freedom and transparency.

Bitcoin’s decentralized structure reduces reliance on central authorities, potentially mitigating the risks associated with government intervention or economic instability.

Researching and Selecting a Reputable Bitcoin Buying Platform

Choosing a reputable Bitcoin buying platform is crucial for security and successful transactions. Thorough research and consideration of key factors are essential.

- Security Measures: Reputable platforms employ robust security measures to protect user funds and data. Look for platforms with multi-factor authentication, encryption, and regular security audits. Consider how the platform handles security incidents.

- Transaction Fees: Transaction fees can vary significantly between platforms. Compare fees and select platforms that offer competitive rates. Consider the cost of transactions when evaluating platforms.

- User Reviews and Reputation: Examining user reviews and platform reputation provides valuable insights into the platform’s reliability and customer service. Research the platform’s track record and identify potential issues or complaints.

- Regulatory Compliance: Reputable platforms adhere to relevant regulatory requirements. Look for platforms that operate within the bounds of local laws and regulations, ensuring compliance.

Illustrative Examples

Bitcoin ATMs offer a convenient, albeit sometimes risky, method for acquiring Bitcoin. Understanding various scenarios, both positive and negative, is crucial for informed decision-making. This section provides illustrative examples of Bitcoin ATM transactions, highlighting both successful and problematic interactions.

User Buying Bitcoin Through a Bitcoin ATM

A user, Alex, needs to acquire Bitcoin. They visit a Bitcoin ATM located in a local shopping center. Alex selects the desired amount of Bitcoin to purchase, inputs their payment method (e.g., credit card), and reviews the transaction details. The ATM displays the Bitcoin address, and Alex confirms the transaction. After successful verification, Alex receives their Bitcoin and a confirmation receipt.

This demonstrates a typical, secure Bitcoin ATM purchase.

Hypothetical Scenario Involving a Fraudulent Bitcoin ATM

A user, Sarah, attempts to buy Bitcoin using a seemingly legitimate Bitcoin ATM. However, the ATM is rigged to display a higher Bitcoin price than the actual market value. The user, unaware of the manipulation, completes the transaction. The user receives a smaller amount of Bitcoin than anticipated. The ATM operator, through various techniques, siphons off a substantial portion of the user’s funds.

This scenario emphasizes the importance of verifying ATM legitimacy and transaction details.

Real-World Example of Bitcoin ATM Usage in a Specific Region

In the United States, Bitcoin ATMs are common in metropolitan areas and are frequently used by those seeking a quick way to acquire Bitcoin for trading or investment. This is often facilitated by convenient location in high-traffic areas. A user in New York City, for instance, may utilize a Bitcoin ATM to purchase Bitcoin for use on a peer-to-peer marketplace or to directly engage in exchanges.

The availability and convenience of ATMs can drive local Bitcoin adoption.

Detailed Example of a Secure Bitcoin ATM Transaction

A user, David, wishes to purchase Bitcoin at a reputable Bitcoin ATM. Before initiating the transaction, David verifies the ATM’s legitimacy by checking its official website for operational status and security measures. He carefully scrutinizes the displayed transaction details, ensuring they align with the expected Bitcoin price and fees. David enters the correct payment information, confirming the transaction after reviewing every step.

This meticulous approach minimizes potential risks and guarantees a secure purchase.

Comparison of Real-World Examples of Bitcoin ATM Usage

| Location | User Type | Transaction Type | Outcome | Security Measures |

|---|---|---|---|---|

| New York City, USA | Investor | Bitcoin purchase for trading | Successful transaction, although with slight price fluctuations | ATM had verification procedures and security certificates |

| London, UK | Retailer | Bitcoin payment for goods | Smooth transaction, but ATM was slightly slower than expected | ATM had an official certification |

| Tokyo, Japan | Crypto Enthusiast | Bitcoin purchase for personal use | Transaction completed, but encountered minor technical difficulties | ATM appeared to be regulated |

This table provides a glimpse into diverse real-world Bitcoin ATM usage examples, highlighting variations in location, user type, transaction type, and outcomes. Note that outcomes and security measures are not exhaustive and can vary.

Future Trends in Bitcoin ATM Transactions

The landscape of Bitcoin ATM transactions is poised for significant evolution. As adoption grows and technology advances, the future of these ATMs is likely to incorporate innovations in accessibility, security, and functionality. This evolution will be influenced by a complex interplay of regulatory developments and the ever-changing blockchain ecosystem.The future of Bitcoin ATM transactions is a dynamic area of discussion, encompassing predictions about adoption, technology, and regulatory frameworks.

These trends will undoubtedly shape the user experience and the overall market for cryptocurrency transactions.

Projected Timeline for Bitcoin ATM Evolution

The Bitcoin ATM market is experiencing a period of rapid change, influenced by the constant advancement of underlying technologies. A clear timeline for the future of this market is challenging, but some key stages can be anticipated.

- Early Stages (2024-2026): Continued expansion in geographic reach and increased ATM functionality, including enhanced user interfaces and support for more cryptocurrencies. Expect to see the integration of newer security protocols, possibly based on biometric verification.

- Intermediate Stages (2027-2029): Emergence of specialized Bitcoin ATMs catering to niche markets, such as institutional investors or specific communities. Expect the development of features supporting automated trading and arbitrage opportunities, and potentially, integrated payment processing.

- Advanced Stages (2030 and Beyond): Greater integration with other financial systems, potentially including traditional banking institutions. This could involve the implementation of real-time settlement mechanisms and enhanced compliance features in response to regulatory changes. Expect the potential for decentralized autonomous organizations (DAOs) to play a larger role in ATM management and operations.

Potential Innovations in Bitcoin ATM Technology

Several advancements in technology could reshape the Bitcoin ATM experience. These include not only improvements in existing features but also the introduction of novel concepts.

- Enhanced User Interfaces (UIs): More intuitive and user-friendly interfaces are expected. This will involve improved navigation and the ability to handle multiple cryptocurrencies simultaneously. Advanced features such as AI-powered recommendations could personalize the user experience. Imagine ATMs that guide users through complex transactions with step-by-step instructions.

- Integration with Mobile Wallets: The seamless integration of Bitcoin ATMs with mobile wallets will likely become standard, allowing for secure and convenient transactions without the need for physical cards or tokens. The user experience will become more streamlined and less cumbersome.

- Biometric Authentication: Implementation of biometric authentication, such as fingerprint or facial recognition, could enhance security and reduce the risk of fraud. This would make transactions more secure and personal. The integration of security protocols can further protect against theft or unauthorized access.

Impact of Regulations on Bitcoin ATMs

Regulatory frameworks will play a significant role in shaping the future of Bitcoin ATMs. Different jurisdictions are likely to adopt varying approaches, leading to a complex regulatory environment.

- Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is crucial for the industry’s future. Stricter regulations are anticipated, driving the development of robust compliance features within Bitcoin ATMs. For example, increased verification requirements could result in more extensive data capture during transactions.

- Varying regulations across jurisdictions will create a complex compliance landscape. This will lead to regional differences in the availability and functionality of Bitcoin ATMs. For example, some regions might restrict the types of cryptocurrencies that can be traded through ATMs.

- Regulatory uncertainty could impact investment and innovation. Clarity in regulatory frameworks is essential for attracting investment and encouraging further innovation in Bitcoin ATM technology. Clear guidelines can foster a more predictable and stable market environment.

Blockchain Technology’s Role in Bitcoin ATM Evolution

Blockchain technology forms the bedrock of Bitcoin and other cryptocurrencies. Its impact on Bitcoin ATM evolution is multifaceted.

- Improved Security and Transparency: Blockchain’s inherent security features can enhance the integrity and transparency of Bitcoin ATM transactions. Increased security measures and transparency are essential elements for broader adoption.

- Decentralization and Accessibility: Blockchain’s decentralized nature can contribute to the accessibility and availability of Bitcoin ATMs across different regions. The decentralization aspect of blockchain technology could reduce reliance on centralized intermediaries.

- Integration of Smart Contracts: Smart contracts could automate various aspects of Bitcoin ATM transactions, potentially streamlining operations and reducing costs. This can lead to greater efficiency and cost reduction in the ATM operation.

Final Conclusion

In conclusion, Bitcoin ATMs provide a readily accessible avenue for purchasing Bitcoin, though they come with their own set of considerations. By weighing the pros and cons, understanding the security measures, and researching reputable providers, you can confidently engage with this method. The future of Bitcoin ATM technology holds promise, with potential for greater accessibility and innovation.

Popular Questions

What are the typical transaction fees for Bitcoin ATMs?

Transaction fees vary significantly between Bitcoin ATM providers, often dependent on the amount purchased and the specific provider. It’s essential to check with the provider directly for current pricing.

How secure are Bitcoin ATM transactions?

Reputable Bitcoin ATM providers employ robust security measures. However, using unverified ATMs carries inherent risks. Always verify the provider’s legitimacy before conducting a transaction.

What payment methods are accepted at Bitcoin ATMs?

Most Bitcoin ATMs accept cash deposits. Some may also support other payment methods, such as credit or debit cards, but this is not universal. Always confirm the ATM’s capabilities beforehand.

Are there any alternatives to buying Bitcoin via ATMs?

Yes, various alternatives exist, including traditional cryptocurrency exchanges, which offer more diverse features and potentially lower fees, but often require more user-interface knowledge.